Understanding Your Credit Score

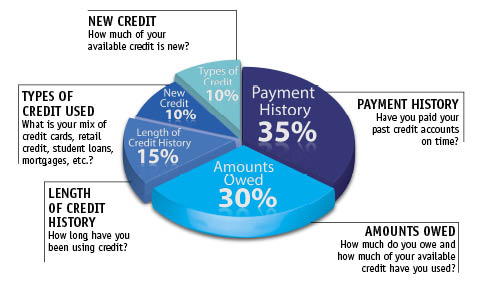

How is your Score Determined?

Payment History

35% of your credit score is determined by your payment history. Simply, if you make your debt payments on time, your credit score may be on the rise. Late debt payments are reported to the credit agencies and can damage your credit.

Amounts Owed

30% of your credit score is determined by your outstanding debt. Managing the amount you owe versus your available credit is heavily weighted in determining your credit score. For example, if you have a credit card with a limit of $1,000 and you have a balance of $998 your score may be negatively impacted. It is best to keep your balances to at or below 30% of what is available. In our example, it would be at or less than a $300 balance.

Length of Credit History

There is a direct positive impact on your credit score the longer you can show a history of being a responsible account holder. However opening new accounts can negatively impact your credit scores. It is important to keep this in mind with all of the available credit opportunities for consumers.

Types of Credit

10% of your credit score is determined by the mix of account types that you have. These include revolving (credit card), installment, (auto, student loan, etc.), and mortgage accounts within your credit profile.

10% of your credit score is determined by the number of new accounts that you have. Businesses pulling your credit are factored into this category. If you are frequently opening new accounts, it can negatively impact your credit score. It is important to understand that not all credit inquiries are created equal. When shopping for a mortgage, credit inquiries made in the 30 days prior to the scoring request are ignored in the FICO scoring. this allows consumers to shop for a mortgage without potentially damaging their credit score in the process.